Islamic Personal Wealth Management: Responsibilities and Estate Distribution

Struggling to manage wealth Islamically? Uncover the wealth management method that ensures both worldly success and Allah's pleasure.

As a Muslim, do you know how wealth can be managed in a way that benefits both your life here and your eternal life beyond?

Islamic Personal Wealth Management is a comprehensive approach that aligns financial practices with Islamic teachings and principles, aiming to benefit both the individual in this life and the hereafter. This approach goes beyond merely accumulating wealth, it encompasses responsible earning, saving, investing, protecting, purifying, and ultimately distributing wealth according to Shariah law (Ariff & Shamsher, 2020; Kamri & Daud, 2011). For Muslims, managing wealth is not merely a financial activity but a religious obligation with unique responsibilities that have both worldly and spiritual implications which include avoiding usury (Riba), uncertainty (Gharar), gambling (Maysir), and the use of prohibited elements in this world.

Islamic Personal Wealth Management integrates Islamic financial planning and investment portfolio management, providing Muslims with a way to generate returns in compliance with Islamic rules and principles. The primary goal is not just the accumulation of wealth but its ethical management and distribution in line with Shariah, ensuring that the wealth serves the needs of the individual, their family, and the broader community (Kamri & Daud, 2011; Mohamed, 2021)

The Role of Contemporary Islamic Finance in Wealth Preservation and Management

In modern times, several Islamic financial instruments and institutions play a significant role in wealth preservation and management. One of the most notable is Takaful, which provides Islamic insurance by pooling funds that are used to assist participants who suffer a loss. Takaful ensures that wealth is protected against unforeseen events without engaging in Riba (interest) or Gharar (excessive uncertainty), making it a crucial tool for wealth protection (Shakirah, 2023). Additionally, Islamic instruments in the Islamic capital market and Investment options such as Sukuks, Shares, Islamic Unitrust, and Islamic Mutual Funds are some notable instruments that contemporary Muslims depend on in generating wealth aside from their usual means through employment or self-employment. (Alpen Capital & Alpen Asset Advisors, 2021; Mohamed, 2021; Ariff & Shamsher, 2020). Similarly, Islamic banks also provide options for Muslims to save their money without the involvement of Riba while providing financing upon need and giving options to make placements with a return using Shariah-compliant contracts such as Mudarabah (Ariff & Shamsher, 2020; Alpen Capital & Alpen Asset Advisors, 2021).

Tabung Haji is another important institution in Malaysian jurisdiction that facilitates Muslims savings for the Hajj pilgrimage. It offers a Shariah-compliant savings scheme that not only helps individuals save for religious obligations but also ensures that their savings are managed and invested in halal ventures, thereby preserving and growing their wealth in a manner consistent with Islamic principles (Abu Bakar, Yasin, & Abu Bakar, 2020; Mohamed, 2021). These are just some contemporary aspects, and the following will illustrate the stages of Islamic wealth management along with Practical mechanisms to be applied in each stage.

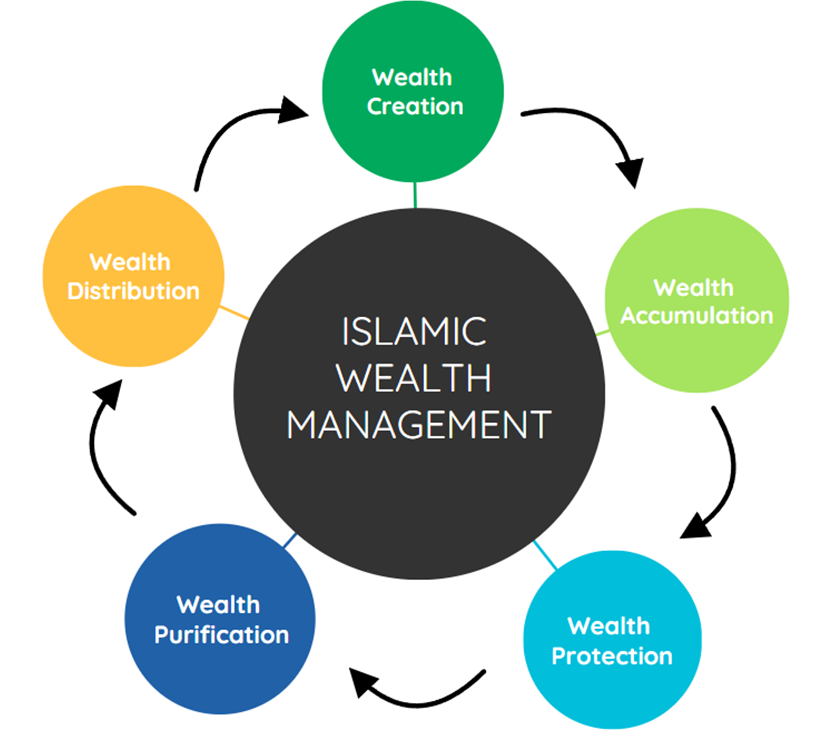

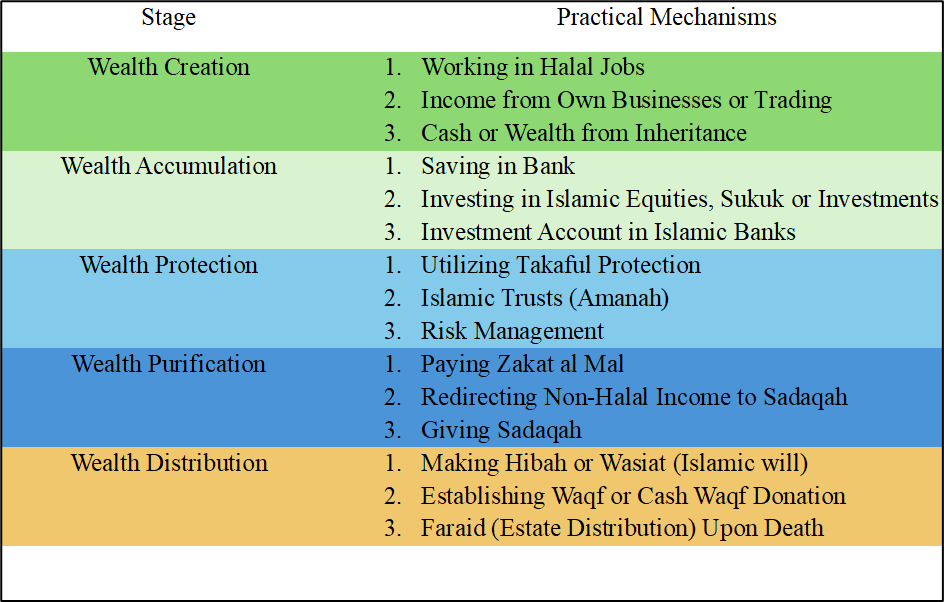

Key Stages of Islamic Wealth Management

Source; Adapted from (Basah & Tahir, 2019; Amanda, Possumah, & Firdaus, 2018; Maybank, 2021).

This structured approach ensures that every aspect of wealth management is aligned with Islamic values, promoting not only financial security but also ethical and spiritual growth.

The Role of Wasiyyat (Islamic Will)

A Wasiyyat is an Islamic will that plays a crucial role in estate planning within the framework of Islamic personal wealth management. While Islamic inheritance laws (Faraid) dictate specific shares for heirs, the wasiyyat allows a Muslim to bequeath up to one-third of their estate to non-heirs, such as charitable causes or individuals who are not entitled to a share under Faraid (Ahmad, 2020). This bequest must not exceed one-third of the total estate, in accordance with the Sunnah of the Prophet Muhammad (ﷺ).

Narrated Sa`d bin Abu Waqqas:

“The Prophet (ﷺ) came visiting me while I was (sick) in Mecca, ('Amir the sub-narrator said, and he disliked to die in the land, whence he had already migrated). He (i.e. the Prophet) said, “May Allah bestow His Mercy on Ibn Afra (Sa`d bin Khaula).” I said, “O Allah's Messenger (ﷺ)! May I will all my property (in charity)?” He said, “No.” I said, “Then may I will half of it?” He said, “No”. I said, “One third?” He said: “Yes, one third, yet even one third is too much. It is better for you to leave your inheritors wealthy than to leave them poor begging others, and whatever you spend for Allah's sake will be considered as a charitable deed even the handful of food you put in your wife's mouth. Allah may lengthen your age so that some people may benefit by you, and some others be harmed by you.” At that time Sa`d had only one daughter.” (Sahih al-Bukhari 2742)

This Hadith emphasizes the importance of balancing charity with the welfare of one's family, allowing for a Wasiyyat of up to one-third of the estate, while ensuring that the remaining wealth is appropriately distributed among the heirs according to Faraid. The Quran highlights the importance of making a Wasiyyat, especially when one is near death, ensuring that debts and obligations are fulfilled:

“كُتِبَ عَلَيۡكُمۡ إِذَا حَضَرَ أَحَدَكُمُ ٱلۡمَوۡتُ إِن تَرَكَ خَيۡرًا ٱلۡوَصِيَّةُ لِلۡوَٰلِدَيۡنِ وَٱلۡأَقۡرَبِينَ بِٱلۡمَعۡرُوفِۖ حَقًّا عَلَى ٱلۡمُتَّقِينَ”

“It is prescribed, when death approaches any of you, if he leave any goods that he make a bequest to parents and next of kin, according to reasonable usage; this is due from the Allah-fearing” (Quran, Surah Al-Baqarah 2:180)

Islamic Estate Distribution

Islamic inheritance laws, known as Faraid, dictate how a Muslim's estate should be distributed upon their death. Before distribution, the estate is used to pay off any debts, including funeral expenses (Zuleika & Desinthya, 2014). The remaining wealth is then distributed among the heirs according to specific shares outlined in the Quran as follows;

“Allah instructs you concerning your children: for the male, what is equal to the share of two females. But if there are [only] daughters, two or more, for them is two thirds of one's estate. And if there is only one, for her is half. And for one's parents, to each one of them is a sixth of his estate if he left children. But if he had no children and the parents [alone] inherit from him, then for his mother is one third. And if he had brothers [or sisters], for his mother is a sixth, after any bequest he [may have] made or debt. Your parents or your children - you know not which of them are nearest to you in benefit. [These shares are] an obligation [imposed] by Allah. Indeed, Allah is ever Knowing and Wise. Quran (Surah An-Nisa, 4:11)

And for you is half of what your wives leave if they have no child. But if they have a child, for you is one fourth of what they leave, after any bequest they [may have] made or debt. And for the wives is one fourth if you leave no child. But if you leave a child, then for them is an eighth of what you leave, after any bequest you [may have] made or debt. And if a man or woman leaves neither ascendants nor descendants but has a brother or a sister, then for each one of them is a sixth. But if they are more than two, they share a third, after any bequest which was made or debt, as long as there is no detriment [caused]. [This is] an ordinance from Allah, and Allah is Knowing and Forbearing. Quran (Surah An-Nisa, 4:12)

The distribution shown below is consistent with the principles outlined in the above verses of Quran (Surah An-Nisa, 4:11-12) and further supported by classical Islamic jurisprudence texts, such as those by Al-Misri (1997) and Al-Qurtubi (2003).

Simplified Breakdown of Islamic Estate Distribution

|

Heirs |

Share if a Muslim Man Passes Away |

Share if a Muslim Woman Passes Away |

|

Father |

1/6 if there are children; otherwise,

more |

1/6 if there are children; otherwise,

more |

|

Mother |

1/6 if there

are children; 1/3 if no children and no siblings |

1/6 if there

are children; 1/3 if no children and no siblings |

|

Husband |

Not Applicable |

1/2 if there are no children; 1/4 if

there are children (son) |

|

Wife |

1/8 if there

are children; 1/4 if there are no children |

Not

Applicable |

|

Children (Sons) |

Remaining balance (twice the share of

daughters) |

Remaining balance (twice the share of

daughters) |

|

Children (Daughters) |

Half the

share of sons |

Half the

share of sons |

|

Siblings (Brothers and

Sisters) |

Inherit only in specific circumstances

(e.g., if no direct descendants or parents) |

Inherit only in specific circumstances

(e.g., if no direct descendants or parents) |

This ensures that the estate is divided fairly and justly, providing peace of mind to the deceased's family and fulfilling the Islamic obligation of fair inheritance distribution.

Unique Aspects of the Islamic Wealth Management Approach

One of the unique aspects of Islamic wealth management, as highlighted in the document provided by Mohamed (2021), is its holistic integration of financial and spiritual well-being. This approach goes beyond conventional wealth management by ensuring that every financial decision, from earning to spending and distributing wealth, is made with the consciousness of fulfilling religious obligations and securing a place in the hereafter. The emphasis on ethical investments, protection of wealth through Takaful, and the purification of wealth through Zakat underscores the deeply spiritual foundation of Islamic wealth management, making it not just a financial responsibility but a comprehensive lifestyle choice that aligns with Islamic values.

Moreover, the structured approach of incorporating both mandatory (Faraid) and voluntary (Wasiyyat) components into wealth distribution ensures that a Muslim’s wealth is managed in a manner that fulfils both personal obligations and communal responsibilities, reflecting the unique balance between individual rights and social justice that is central to Islamic law.

Conclusion

Islamic personal wealth management is a crucial practice that intertwines financial responsibility with religious duty. By following the structured stages of wealth management encompassing wealth production, accumulation, protection, purification, and distribution Muslims can ensure that their financial decisions serve both their worldly needs and spiritual goals. The emphasis on ethical investment, protection of wealth through Takaful, and purification of wealth through Zakat underscores the spiritual foundation of Islamic wealth management.

Moreover, the Prophet Muhammad (ﷺ) provided guidance on the use of up to one-third of one's wealth through a wasiyyat (Islamic will) for charitable purposes, stating that “One-third, and one-third is much” (Sahih al-Bukhari 2742). This guidance emphasizes the importance of balancing personal and familial obligations with social responsibility, ensuring that wealth is distributed in a manner that benefits the community while adhering to Islamic principles.

By incorporating both Faraid (Islamic inheritance law) and voluntary acts of charity through Wasiyyat, Islamic wealth management allows Muslims to fulfil their religious obligations while contributing positively to society. In essence, Islamic personal wealth management is not just about financial stability but about fulfilling one’s duties to Allah and society, leaving a lasting legacy of righteousness and responsibility.

Allahu Au'lam (Allah Knows Best)!

Disclaimer: The views expressed in this blog are not necessarily those of the blog writer and his affiliations and are for informational purposes only.

If you found this blog post insightful, don’t forget to subscribe to our website for more updates. Your subscription will help us continue to bring you the latest insights. And if you think this post could benefit others, please feel free to share it. Let’s spread the knowledge together!

References

- Abu Bakar, N. M., Yasin, N. M., & Abu Bakar, N. H. (2020). The contemporary role of Tabung Haji Malaysia in fulfilling sustainability via Islamic social finance. Journal of Islamic Finance, 9(2), 59-69. Retrieved from https://journals.iium.edu.my/iiibf-journal/index.php/jif/article/download/484/207/1328

- Ahmad, M. A. R. (2020). Will (Wasiyyah) as an alternative in Muslim estate planning. In Proceedings of the 7th International Conference on Management and Muamalah 2020 (ICoMM 2020) (pp. 330-338). Universiti Pendidikan Sultan Idris. https://conference.uis.edu.my/icomm/7th/images/eprosiding/32_Mohamad_Ali_Roshidi.pdf

- Al-Misri, A. R. (1997). Reliance of the Traveller: A Classic Manual of Islamic Sacred Law. Amana Publications.

- Alpen Capital & Alpen Asset Advisors. (2021). Islamic finance and wealth management report. Alpen Capital. Retrieved from https://argaamplus.s3.amazonaws.com/86f171a0-dcdc-4a26-b7f1-35345c16f250.pdf

- Al-Qurtubi, M. A. (2003). Al-Jami' li Ahkam al-Qur'an (The Compendium of Legal Rulings of the Quran), Dar al-Kutub al-Misriyyah.

- Amanda, F., Possumah, B. T., & Firdaus, A. (2018). Consumerism in personal finance: An Islamic wealth management approach. Al-Iqtishad Journal of Islamic Economics, 10(2). https://www.researchgate.net/publication/325188648_Consumerism_in_Personal_Finance_An_Islamic_Wealth_Management_Approach

- Ariff, M., & Shamsher, M. (2020). Islamic wealth management: Issues in Waqf management in Malaysia. INCEIF. Retrieved from https://inceif.edu.my/flip-book/islamic-social-finance/pdf/islamic_wealth_management_issues_waqf_management_malaysia_ariff_shamsher.pdf

- Basah, S., & Tahir, P. R. (2019). Towards acceptance of Islamic wealth management. Retrieved from https://www.semanticscholar.org/paper/TOWARDS-ACCEPTANCE-OF-ISLAMIC-WEALTH-MANAGEMENT-Basah-Tahir/a067ad1bd64805fed9da985af35df4dc5cf6d10b

- Kamri, N. A., & Daud, M. Z. (2011). Islamic wealth management: A review on the dimension of values. Jurnal Syariah, 19(3), 187-212. Retrieved from https://ejournal.um.edu.my/index.php/JS/article/download/22631/11231/49040

- Maybank. (2021). Shariah-compliant investing: A guide for beginners. Retrieved from https://www.maybank2u.com.sg/en/imsavvy/wealth-post/Shariah-compliant-investing.html

- Mohamed, I. (2021). Islamic financial wealth plan (Unpublished financial plan).

- Quran, Surah Al-Baqarah (2:180).

- Quran, Surah An-Nisa (4:11-12).

- (Sahih al-Bukhari 2742).

- Shakirah, A. (2023). Takaful: The objectives of Shariah compliance in Islamic insurance. Ethis. Retrieved from https://ethis.co/blog/takaful-objectives-shariah/

- Zuleika, A., & Desinthya, N. P. (2014). Islamic inheritance law (Faraid) and its economic implication. Tazkia Islamic Finance and Business Review, 8(1), 1-12. Semantic Scholar. https://www.semanticscholar.org/paper/Islamic-Inheritance-Law-(Faraid)-and-Its-Economic-Zuleika-Desinthya/ac215df00083e7aa4ed763f113ffb7f6512e1d60