Current Islamic Finance: Circular or Linear Economy?

In the quest for a sustainable Islamic finance industry, it is imperative to understand if the industry is a linear or circular economy.

The Islamic finance industry is currently facing a number of challenges, as there is a significant gap between the theoretical foundation and the applied practices in the industry. Therefore, it is argued that the present Islamic finance system is not the true reflection of the ideology presented by Shariah.

Source: Khan (2019)

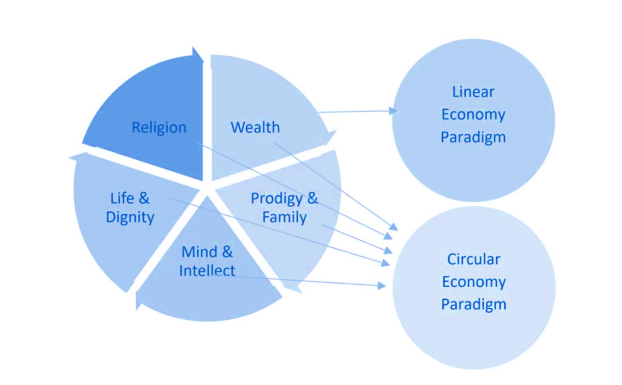

In order to improve the current economic model followed by Islamic finance, it is necessary to understand the existing system. At present, the economy is perceived as a “Halal subset” of the linear economy (Khan, 2019). To be parallel with the fundamental standards and ideology presented by the objectives of the shariah, Islamic finance had to pursue more circular activities. Khan (2019) has presented four scenarios where he mentioned Islamic finance can be at one of these paradigms: Partly linear and partly circular, more linear than circular, more circular than linear, and neither linear nor circular.

Based on the criteria or screening process followed by Islamic finance, it can be stated that it is more linear than circular. Because the screening only allows eliminating the income which is not halal or in other words wealth maximization in a halal way. Thus, this criterion alone is not enough for the Islamic finance industry to have a social impact rather than having only an economic impact. So, it is crucial for Islamic finance to include the environmental, social, and governance concerns apart from only following what is acceptable as well as avoiding the forbidden sectors.

Green Sukuk, SRI and Circular Economy

Until now the issuance of green Sukuk is designed such a way to invest in environmental-friendly projects, climate-resilient growth, and sustainability (Rahim and Mohamad, 2019). The growing interest in green Sukuk is not only because of the spontaneous development of the Sukuk market but also in line with the demand of investors’ responsiveness to ethical and socially responsible investment.

The green projects, which are funded using Sukuk, are clean energy, water preservation, mass transit, forestry, recycling, and low-carbon technologies. These projects are also in line with the objectives of a circular economy. Therefore, these green Sukuks address both environmental and economic affairs. Creating and investing in sustainable development projects and reducing the impact on the environment is the key focus of green Sukuks. For additional disclosure, green Sukuk can add SDG reporting in their financial transaction or reporting.

Zero waste culture, a primary object of the circular economy can also be addressed through green Sukuks. This type of Sukuk can be used to inaugurate effective supply chain management. For those organizations that want to implement a circular economy but changing the whole business model is not feasible, they can collaborate with the related organization and create a separate entity that will be liable for the circular process. The separate entity can be funded by green Sukuk, it will fulfil the requirements of both SRI investors and organizations that opt for a circular economy.

If you find this post helpful or interesting, please share it.

Don't forget to follow our @Facebook and @Twitter

References

KHAN, T. 2019a. Reforming Islamic Finance for Achieving Sustainable Development Goals. Journal of King Abdulaziz University: Islamic Economics, 32.

RAHIM, S. R. M. & MOHAMAD, Z. Z. 2019. Green Sukuk for Financing Renewable Energy Projects.