Investment Account in Islamic Banking: How does it work?

One of the key features of Islamic finance is forming a mutual contractual association based on risk-sharing. The principle is based on two fundamentals. Firstly, it is established on trust, justice, fairness, and cooperation. Secondly, it allows joining in profit and/or losses.

One of the key features of Islamic finance is forming a mutual contractual association based on risk-sharing. The principle is based on two fundamentals. Firstly, it is established on trust, justice, fairness, and cooperation. Secondly, it allows joining in profit and/or losses.

As a pioneering country in Islamic finance, Malaysia established the Islamic Financial Services Act (IFSA) 2013 to facilitate the concept of risk-sharing among Islamic banks (IBs). Before IFSA, the IBs didn’t differentiate between risk-sharing and risk-transfer tasks. For instance, Mudarabah accounts were treated as liabilities and deposits and investors were considered creditors to the bank. Therefore, there were no key differences between Mudarabah investment and deposit (Bouheraoua et al., 2016).

Mechanism of Investment Account

The implementation of IFSA started with providing separate definitions for Islamic investment and deposit accounts. According to IFSA, IBs need to separate the funds of customers into either an Islamic deposit account which is treated as risk-free and the principal is guaranteed or an Islamic investment account where customers have to bear the risk and the principal is not guaranteed.

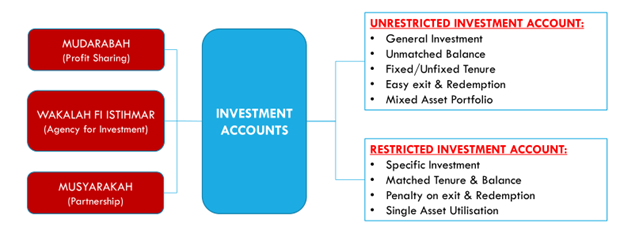

Contracts Under Investment Account

According to BNM (2014), in the Mudarabah contract, one party provides capital, who is known as Rab-ul-mal, to the entrepreneur, who is known as Mudarib, to conduct business and revenue generated from the capital is shared between them in a predetermined ratio. If any losses occur, they should be solely borne by the Rab-ul-mal except if the losses happen because of the Mudaribs’ negligence or misconduct or breach of contracts. In the case of IB, the investment account holders are the Rab-ul-mal and banks act as mudarib.

BNM (2014) defined Musharakah as a partnership contract among parties based on contractual relationship (Aqd) or Islamic Law operation and all parties agree to share profit and borne losses.

IBs and investment account holders both put money into the account and profit and losses are shared based on agreed portions.

In the Wakalah contract, one party known as Muwakkil authorizes another party as his/her agent who is known as Wakil in order to a specific task. This task can be done either voluntarily or in exchange for a fee (BNM, 2014).

In Islamic Banking, the investors are the Muwakkil and IB works as Wakil to manage the fund of investment account.

Unrestricted Investment Account (URIA)

In URIA, the investors provide the funds to IBs in order to invest without imposing any constraints or conditions (BNM, 2014). It is based on Musharakah or Wakalah contract (IBRC, 2017).

Key Features of URIA

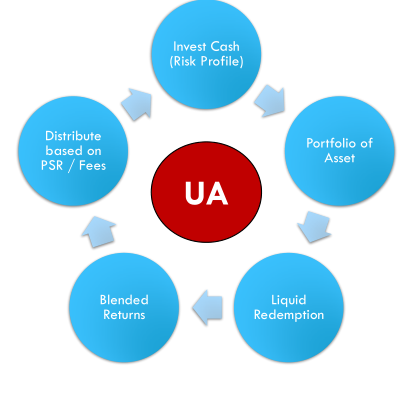

Process Flow of URIA

- The customer is given product disclosure sheets and based on that the bank assesses the risk profile of the customer. Based on the risk profile the customer put the fund into the investment account

- With flexible tenure, investment is made into the portfolio.

- The investor has the option to redeem the fund or additional investments into the portfolio.

- Profit or losses from the portfolio is evaluated after a certain period.

- Profit is distributed based on pre-agreed ratios or fees.

- Based on the mutual agreement investment can be continued or divested.

Restricted Investment Account (RIA)

In RIA, the investors or investment account holders specify the type of investments to banks such as asset class, sectors, tenure, and purpose (BNM, 2014). This account is based on the Mudarabah contract (IBRC, 2017).

Key Features of RIA

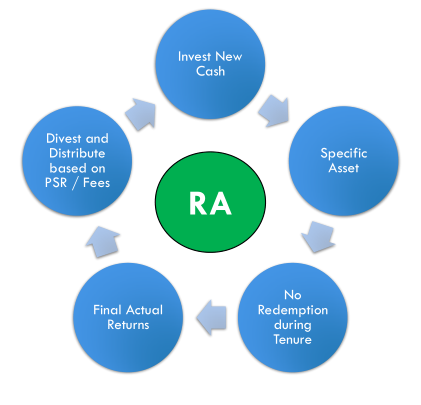

RIA Process Flow

1. The customer provides the fund to the investment account and provides the requirements of investments. The customer assesses the risks of the investments.

2. With fixed maturity or tenure, investments are made into an asset.

3. Before maturity, no redemption is allowed. If the customer still wants to redeem investments, he/she must pay a high penalty charge.

4. At the end of the tenure, profit or losses from the asset are evaluated.

5. The invested asset is then terminated or divested.

6. The profit is distributed based on the pre-agreed ratio.

Challenges of Investment Accounts

Ø Before IFSA, the computation of Rate of Return (ROR) was simple as it was considered as one Mudarabah Deposit pool without any risk profile. Because of IFSA, the banks have to disclose the rate of return for specific investment assets, challenges will arise to track the application as well as the source of the funds to suit the new requirements of ROR (IBRC, 2017).

Ø Different types of investments carry different types as well as the magnitude of risks. Banks’ general retail products such as current accounts or savings accounts are structured as low-risk products. But as investment account holds higher risks, this profiling of investment account takes them outside of the conventional banking space and places them in the investment category. Therefore, it requires a more sophisticated process to provide the service (IBRC, 2017).

Ø Another challenge can be finding a suitable asset to invest in based on the requirements of investors or their risk profile. Developing such a system that will identify and link the assets to the funds will require sophisticated skills and intelligence like fund management.

Ø In terms of RIA, the investor may want to redeem or come out of the investment before maturity. One way can be selling the investment asset into the secondary market to avoid penalties. But the non-presence of the secondary market in this regard makes it impossible for the account holder to liquidate the investment.

Ø According to the study by Adznan (2018), the banks prefer steady returns and most often are reluctant to involve in riskier projects by using the investment fund. Therefore, the majority of investments go to house financing or mortgage financing. And these financings are done through usually Ijarah or Tawarruq which are debt-based and do not reflect true real economic activities. Hence, the usage of the funds becomes more debt-based rather than investments.

Ø In order to provide customers with a steady and safe return, the banks usually invest in low-yield and low-risk projects. It limits the scope of banks to explore more socially responsible or unique business ventures to invest in.

Benefits of Investments Accounts

From the above discussion, it can be seen that the introduction of Investment Accounts is a remarkable step for IBs which will benefit both depositors and entrepreneurs because of the embedded risk-sharing concept. But it is also a challenge for IBs to offer viable ROR at an acceptable risk level in this competitive market.

If you find this post helpful or interesting, please share it.

Don't forget to follow our @Facebook and @Twitter