Integrating Ethics into Economics through Maqasid al-Shariah

Profit vs. people: Is there a middle ground? Islamic economics offers a surprising solution to our financial dilemmas. #IslamicFinance #IslamicEconomy #Sustainability #EconomicEquality

Written By

Opening Insights

In a world where economic decisions often prioritize profit over people, the quest to harmonize ethics with economics has never been more urgent. Imagine an economic system that not only fuels growth but also nurtures the soul of society, a system where every transaction is a step toward justice, equity, and collective well-being. This vision is not just a utopian dream but rather it is deeply rooted in the Islamic tradition, specifically through the concept of Maqasid al-Shariah.

Ethics is defined as “moral principles that govern a person's behaviour or the conducting of an activity” (Knight, 2017). Ethics is also defined by Rich (2020) as “a systematic approach to understanding, analysing, and distinguishing matters of right and wrong, good and bad, admirable and deplorable as they relate to the well-being of and the relationship among sentient beings.”

From both of the definitions above, it is very clear that ethics are principles and ways that are deemed admirable and preferable for the best and wellbeing of the people or group. Ethical directives are subjective and not clearly evident, and people have different opinions on what is right and wrong. As a result, ethics as a subject should be taken to a higher level than just personal ethics opinions. Bringing ethics to the contemporary economic system would require rules, virtues, values, and goods into economic action and management (Springer Nature, 2019). From the economic perspective, ethics should be viewed broadly and collectively compared to what ethics means to an individual with initial conditions.

The Maqasid al-Shariah Approach in Bringing Ethics into Economies

Shariah (or widely referred as Islamic law) is the complete code of the way of life for mankind that incorporates beliefs, conducts and worship, and, morals and ethics. As such, the higher objectives of Shariah or the Maqasid al-Shariah is being a significant concept in guiding the human-to-human transactions (Muamalat) in the Muslim world. The concept of Maqasid al-Shariah is not a direct revelation, however widely acknowledged as the intended outcomes of Islamic law and first was identified by Iman al-Ghazali (in 1111 A.D.) (Sarif, Ismail & Azan, 2017).

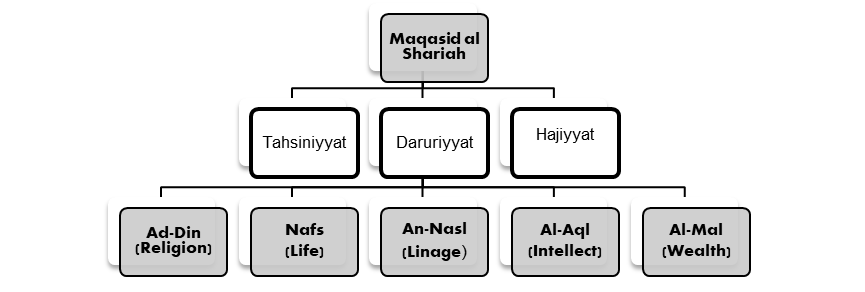

He classified the elements of Maqasid al-Shariah on a hierarchy giving high priority to the Daruriyyat (essentials), followed by Hajiyyat (complementation), and last Tahsiniyyat (embellishments). These three elements are also referred to three categories of Malsahah (public interest/benefit) by operationalizing the Maqasid al-Shariah (Sarif, Ismail & Azan, 2017). He further expanded Daruriyyat (essentials) into five values (1) Nafs (life), (2) Din (religion or Faith), Nasl (Lineage), Aql (intellect) and Maal (property/wealth) (Sarif, Ismail & Azan, 2017). This depicts that all the laws, ethics and principles of Islamic law are intended to protect these five values as the scholars agree on these classification and values through extensive studies they have conducted in the past.

The following figure 1, illustrates Maqasid al-Shariah in broad which will be applied further in determining how ethics can be brought into economics.

Figure 1: Al-Ghazali’s Theoretical Framework of Maqasid al-Shari’ah

Source; Adapted and Added from Rasool, Yusof & Ali (2020)

Ethical decisions establish the preservation of rights and fairness to businesses, customers and other stakeholders in an economy. Similarly, the application of Maqasid al-Shariah would bring harmony through the ethical principles where various Shariah evidence from the primary sources would witness this. Allah says in the Qu’ran:

“I desire no more than to set things to right in so far as it lies within my power, but achievement of my aim depends on God alone” (Surah Hud:88).

Moreover, according to the principles of Shariah law, happiness must be acquainted with ethics by taking all the good virtues in Islam into one, which are Temperance (‘iffah), Abstinence (wara’), Piety (taqwa), and Truthfulness (sidq). With the concept of tauhid (oneness of God), Maqasid al-Shariah guides Muslims on how to obey him fully with the intention of getting happiness from life hereafter. The economic decisions are made with given freedom of choice to the parties where online transactions and other business transaction forms shall apply ethical principles guided by the Shariah. The decisions shall avoid pure self-interest, and instead made in fair and just including mutual cooperation of the parties. Subsequent to that, Allah says In the Qu’ran:

“O’ you who have attained faith, do not devour one another’s possessions wrongfully not even by way of trade based on mutual agreement, and do not destroy one another” (Surah Anisa, 29).

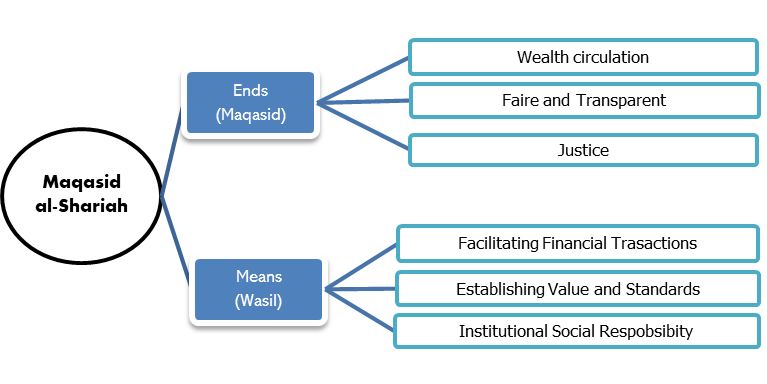

Similarly, policymakers and the legal system also shall adopt and encourage these disciplines in the underlying principles in achieving the aimed outcomes or end goal of the policymakers or government, which is the welfare of society. The following figure 2 shows how Maqasid al-Shariah can be used to achieve the objectives of Islamic economics.

Figure 2. Maqasid al- Shariah Frameworks for the Objectives of Islamic Economics

Source: Adapted from Lambak, et.al, (2019)

With reference to Figure 2, the higher objectives of Islamic Shariah lay down its principles and ethics by dividing them into two major subcomponents: (1) ends (Maqasid) that refer to the outcomes in general, and (2) means (Wasil) ways to facilitate the ethical principles (Lambak, et.al., 2019). Shariah guides us on how to conduct financial transactions in a very clear manner where any form of misconduct or injustice to any party is strictly prohibited and where punishments will be established in the world and if not in the hereafter.

Shariah has prohibited all the elements which create injustice, such as usury (Riba), uncertainty (Gharar) in contracts, gambling (Mysir), threat (Tahdeed), mistake (Ghalat), injustice (Zulm), deception (Khedaa), and exploitation (Istighlal) (Kmeid, 2019). Riba is an unjustified increase in lending money or borrowing money, which is haram in all aspects (Lahsasna, 2009).

In addition to these, any form of involvement in alcohol, pork products, and the adult-entertainment industry violates the ethical principles of human nature (Kmeid, 2019), where Shariah strictly forbade any form of economic activities using them. Economic transactions should take place within a just, responsible, free market economy and business before taking decisions to make profits, wellbeing of society should be taken forward and promote fairness in economic activities. Maqasid al-Shariah is towards removing hardship from the people, whereas the famous Islamic legal maxim "al- ḍarar yuzal (harm must be eliminated)" is also towards encouraging ethics in any given situation.

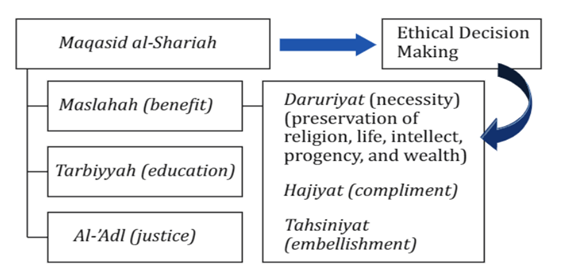

Figure 3. The Effect of Maqasid al-Shariah and Mashahah Concept in Ethical Decision Making

Source: Adapted from Samidi, Karnadi & Nurfadilah, (2018)

As seen in Figure 3, Shariah also focuses on the public interest, promoting education and justice at large. Focusing on the Tarbiyyah, it is not limited to any specific knowledge but evolves around good conduct and manners for all individuals for the prosperity of society. Moreover, ethics in economics can be achieved by promoting the three levels of Maslahah, as shown in Figure 3. In the market economy, firms operate with multiple objectives and a number of stakeholders, and it is important for firms to set social objectives with respect to ethical decisions (Samidi, Karnadi & Nurfadilah, 2018). As a result, it promotes the public interest and brings harmony to the economy.

Achieving Ethics through Wealth Circulation

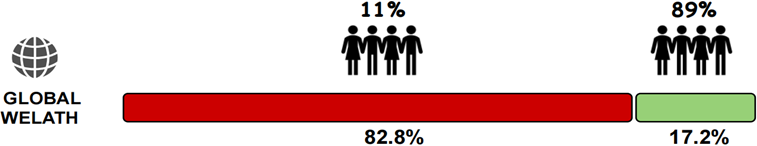

Individuals holding over USD 100,000 in assets make up less than 11% of the global population but own 82.8% of the global wealth for the year 2019 (Ismail, 2020). The following diagram will illustrate the global wealth gap.

Source: Author’s own, information based on the source Ismail (2020).

The gap is massive, where a large population must bear and sacrifice while others enjoy excessive wealth in their possession. This is against the concept of Daruriyyat for equity in access to necessities. Also, hoarding wealth beyond current and future needs is prohibited in Islam, emphasizing the circulation of wealth in society for job creation and other opportunities. In considering life hereafter, waqf and zakat are more prominent in bringing ethics into the picture of the economy, with social justice and zakat as a form of wealth purification, which aligns with Maqasid al-Shariah.

Final Thoughts

Incorporating ethics into economics from an Islamic perspective can be effectively achieved through the concept of Maqasid al-Shariah. By prioritizing the preservation of essential human values such as life, religion, intellect, lineage, and wealth, Maqasid al-Shariah offers a comprehensive framework that aligns economic activities with enduring ethical principles. These values, established over 1400 years ago as a mercy to mankind, have remained consistent in their core intentions and provide a stable foundation that contrasts with the ever-changing nature of man-made laws and principles. Maqasid al-Shariah emphasizes the common good and social justice, challenging the efficiency-driven models of modern economics and offering a pathway toward a more balanced and humane economic system. Moreover, we can never truly harmonize global economies unless we unite under a common ethical framework, such as Maqasid al-Shariah, which offers universal principles that transcend cultural and temporal boundaries. As we look to the future, integrating these timeless Islamic ethical principles into contemporary economics can help address deep-seated issues of inequality and injustice, fostering a system that not only pursues growth but also ensures the well-being of the entire global community.

Disclaimer: The views expressed in this blog are not necessarily those of the blog writer and his affiliations and are for informational purposes only.

If you found this blog post insightful, don’t forget to subscribe to our website for more updates. Your subscription will help us continue to bring you the latest insights. And if you think this post could benefit others, please feel free to share it. Let’s spread the knowledge together!

References

1. Ezamshah Ismail (2020), Wealth Management from the Islamic Perspective. International Centre for Education in Islamic Finance.

2. Kmeid, R. (2019). Prohibitions in the Islamic financial system - Bobsguide. Retrieved 17 September 2021, from https://www.bobsguide.com/articles/prohibitions-in-the-islamic-financial-system/

3.Knight, R. (2017). Ethical principles. University College London (UCL). https://www.ucl.ac.uk/students/policies/conduct/ethical-principles#:~=Ethics%20%2D%20Moral%20principles%20that%20govern,in%20decision%2Dmaking%20and%20actions.

4. Lahsasna, A. (2009). Maqasid al Shariah in Islamic economics and finance. Faculty Of Islamic Studies. National University Of Malaysia. Retrieved from https://www.researchgate.net/publication/321746623_Maqasid_Al_Shariah_in_Islamic_Economics_and_Finance

5. Lambak, S., Ghani, H., Faruk Abdullah, M., & Sulong, Z. (2019). Application of Maqasid al-Shariah Principles in Auto Takaful Underwriting Practices. Isamic Development Management, 199-206. doi: 10.1007/978-981-13-7584-2_15

6. Rasool, M., Yusof, M., & Ali, S. (2020). WELLBEING OF THE SOCIETY: A MAQASID AlSHARI‘AH APPROACH. Centre For Islamic Philanthropy And Social Finance (CIPSF). University Of Technology MARA. 78000. Alor Gajah. Melaka. Malaysia. doi: https://doi.org/10.22452/ afkar.sp2020no1.2

7. Rich, K. (2020). Introduction to Ethics. Jones & Bartlett Learning. https://samples.jbpub.com/9781449649005/22183_ch01_pass3.pdf

8. Samidi, S., Karnadi, M., & Nurfadilah, D. (2018). The Role of Maqasid Al-Shariah and Maslahah in Ethical Decision Making: A Study of Professionals in Indonesia. International Journal Of Business Studies, 1(2), 85-92. doi: 10.32924/ijbs.v1i2.23

9. Springer Nature. (2019). Ethical Economy, Studies in Economic Ethics and Philosophy. Switzerland.

10. Sarif, S., Ismail, Y., & Azan, Z. (2017). Effects of maqasid al-shariah for ethical decision making among social entrepreneurs. Journal Of Islamic Management Studies, Vol. No. 1 Issue No. 1, 2017, Pp. 01-14. Retrieved from http://irep.iium.edu.my/57131/